Indian Economy May Contract 0.4% in FY21 on Coronavirus Pandemic, Say Two Foreign Brokerages

Japanese brokerage Nomura warned of a likely downgrade of the sovereign by global ratings agencies while American brokerage Goldman Sachs (GS) said RBI will cut rates by another 1 percentage point to arrest the economic slide.

CII Bats for Immediate Stimulus Package of Rs 15 Lakh Crore

Confederation of Indian Industry said a substantive stimulus is required from the government in the form of support to the poor and to the industry.

Covid-19 Impact: Govt Hikes Market Borrowing Limit To Rs 12 Lakh Crore For Financial Year 20-21

Finance Minister Nirmala Sitharaman in her Budget for 2020-21 had pegged gross borrowing in the new financial year at Rs 7.8 lakh crore, higher than Rs 7.1 lakh crore estimated for 2019-20.

Coronavirus Lockdown: PSBs Have Sanctioned Loans Worth Rs 42,000 Crore To MSMEs, Corporates So Far

Many MSMEs and corporates have also availed the three-month moratorium offered by banks as per the Reserve Bank of India

Record Excise Duty Hike Unlikely to Help Bridge Fiscal Gap: Report

Despite crude prices trading at a two decades low, the government had earlier this week hiked excise duty on petrol by Rs 10 a litre and on diesel by Rs 13 a litre to mop up nearly Rs 1.6 lakh crore in additional revenue this fiscal.

Sensex Ends 199 Points Higher; Reliance Industries Rallies over 3 Percent

After rallying 645.13 points during the day, the 30-share index surrendered most gains to settle 199.32 points or 0.63 per cent higher at 31,642.70.

Equity Mutual Fund Inflows Hit 4-month Low of Rs 6,108 Crore in April

Overall, the mutual fund industry witnessed net inflows of Rs 45,999 crore across all segments, data by the Association of Mutual Funds in India showed on Friday.

India May See 0% GDP Growth This Fiscal Year, Says Moody's

The ratings agency said it expected India to see no growth in financial year 2021 and bounce back to a 6.6% GDP growth in FY22.

India's Rating Outlook Reflects Rising Risk of Slower GDP Growth, Low Policy Effectiveness: Moody's

Moody's Investors Service on Friday said the negative outlook on India's rating reflects increasing risks that GDP growth will remain significantly lower than in the past and partly hints at weaker policy effectiveness to address economic and institutional issues.

Rupee Rises 45 Paise to 75.27 Against US Dollar in Early Trade Amid Covid-19 Concerns

Forex traders said a positive start of domestic stocks and significant foreign fund inflows supported the local unit.

Sensex Rallies Over 600 Points in Early Trade; RIL Jumps 2% After Jio-Vista Equity Fund Deal

Equity benchmark Sensex rallied over 600 points in opening session on Friday as strong gains in index-heavyweight Reliance Industries, massive foreign fund inflow and positive global cues boosted market sentiment.

Cognizant Q1 Net Falls 16.7% to $367 Million; Sees Challenging Demand Environment in 2020

Cognizant follows January-December as financial year. Its net profit was at USD 441 million in the March 2019 quarter.

Asia Stocks Poised to Rise as Upbeat Earnings Trump Jobs Gloom

The upbeat sentiment follows gains of over 1% in main U.S. and European stock indexes on Thursday.

Reliance Jio Sells 2.3% Stake to US Tech Fund Vista Equity Partners for Rs 11,367 Crore

This is the third high profile-investment in Reliance Jio in as many weeks.

Public Sector Banks Sanctioned Rs 5.66 Lakh Crore Loans during March-April: Nirmala Sitharaman

She further said that state-owned banks implemented the moratorium announced by the RBI on repayment of loans.

Sebi Asks Franklin Templeton Mutual Fund to Focus on Returning Investors' Rs 25,000 Crore at Earliest

Sebi also said 'some mutual fund schemes' continued to invest in high risk and 'opaque' debt securities despite the regulatory framework having been amended for safeguarding investors' interest.

SBI Hikes Home Loan Rates by Up to 30 Basis Points

The lender has also hiked interest rates on personal loans against property by 30 basis points.

Government Should Now Let the Economy Function Post-lockdown: Kaushik Basu

The global market is fearing that India would slide into a 'controlled economy', which would be very damaging, Basu added.

Petrol, Diesel to Cost More in Rajasthan with Third Hike in VAT Rates amid Covid-19 Lockdown

The state government on Thursday increased the VAT on petrol to 38 per cent from 36 per cent earlier while on diesel to 28 per cent from 27 per cent earlier.

Govt Buys 216 Lakh Tonnes Wheat from Farmers at MSP so far, More Than Half of Target

The procurement of wheat and rice (second crop) during the ongoing Rabi season has picked up pace despite severe logistical constraints posed due to countrywide lockdown," the food ministry said in a statement.

CAIT Flags Traders' Inability to Pay Full Salary for April, Seeks Goyal's Intervention

The Confederation of All India Traders (CAIT) has written to Commerce and Industry Minister Piyush Goyal seeking his intervention in the matter.

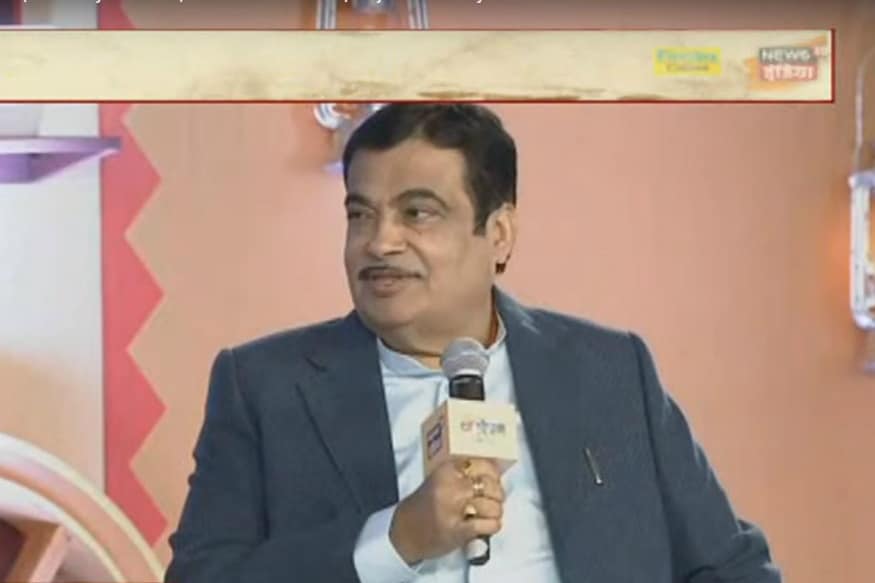

MSME Sector on Verge of Collapse, Says Nitin Gadkari; Urges Industries to Clear Outstanding Dues

The minister also noted that the pendency of dues owed to MSME units by the central government, state governments, public sector undertakings and major industries was "very high".

Yes Bank Creates Stressed Asset Management Vertical to Resolve NPA Accounts

Yes Bank's board had to be superseded by the RBI and the government earlier this year after alleged mismanagement under its founder CEO Rana Kapoor.

India Exports 33.5 Lakh Tonnes Sugar so Far in 2019-20 Marketing Year

With five months still left for 2019-20 marketing year to end, the association feels the mills have the potential to fulfil their exports commitments.

Govt Working on Financial Package for all Sectors of Economy, Says Official

Participating in the same meeting, Union Minister for MSME and Road Transport and Highways Nitin Gadkari also said "a package is going to be declared".

ArcelorMittal Reports $1.1 Billion Net Loss in Jan-Mar Quarter

The world's largest steelmaker had posted a net income of USD 0.4 billion in the year-ago quarter.

Coronavirus Lockdown: India's Coal Import Declines by 29 Percent in April

Coal Minister Pralhad Joshi had earlier written to state chief ministers asking them not to import dry-fuel and take the domestic supply of fuel from Coal India Ltd.

Sensex Drops 242 Points, Nifty Gives up 9,200-mark amid Coronavirus Pandemic

ONGC was the top loser in the Sensex pack, slumping over 4 per cent, followed by NTPC, Kotak Bank, Titan, Bharti Airtel and PowerGrid.

SBI Cuts Benchmark Lending Rate by 15 Basic Points, New Special Deposit Scheme For Senior Citizens

Under this new product, an additional 30 basis points premium will be payable for senior citizen's retail term deposits with "5 Years & above" tenor only.

India to Send Investment Pitches to More Than 1,000 American Companies to Relocate From China: Report

India is prioritizing medical equipment suppliers, food processing units, textiles, leather and auto part makers among more than 550 products covered in the discussions.

Steel Giant ArcelorMittal Reports Net Loss of $1.1 Billion in First Quarter Amid Coronavirus

The company also had to reduce production due to reduced demand.

Kotak Mahindra Bank Declares 10 Per cent Pay Cut for Staff with Over Rs 25 Lakh Annual Salary

The move from Kotak Mahindra comes weeks after the top management voluntarily surrendered 15 per cent of their payments for 2020-21.

MSMEs Need Govt Push to Benefit from Comparative Advantage over China-made Consumer Goods: Report

It further said that although 2020 is a lost year, in terms of trade, India can think long-term and build relations so that it can occupy the space vacated by China.

Britain's GlaxoSmithKline to Sell Entire Stake in Hindustan Unilever for Rs 254.8 Billion

GSK has agreed to sell its entire stake in Unilever's Indian business for about 254.8 billion rupees ($3.35 billion) on the open market, cashing in late from the sale of the Horlicks brand.

Sensex, Nifty Slip as Coronavirus Cases Jump; Hindustan Unilever Drops

Indian stocks slid on Thursday, with declines led by banks and Hindustan Unilever, as coronavirus cases in the country crossed 50,000 despite a strict weeks-long lockdown.

Oil Gains as US Inventories Grow Less Than Feared While Coronavirus Slashes Demand

While prices have risen sharply since late April as some countries have started easing lockdowns put in place to combat the worst pandemic in a century, oil continues to be pumped into storage, leaving a massive mismatch between demand and supply.

US Private Hiring Collapses in April, Plunging 20.2 Million, Says Payroll Firm ADP

However, the data only reflect company payrolls through April 12 so the report does not reflect the full impact of COVID-19 on the overall employment situation.

Govt Allows Businesses to Verify Monthly GST Return through EVC

Currently, businesses are required to digitally sign GSTR-3B form while filing monthly return and paying taxes.

Gilead Sciences Scouting For Partners in India, Pakistan for Remdesivir

Remdesivir is an investigational antiviral drug that may be found effective against the virus that causes Covid-19

EPFO Allows Employers to Register Digital Signatures via Email

Currently, authorised persons of employers have to go to the Employees' Provident Fund Organisation (EPFO) offices to get their digital signatures registered.

Sensex Ends 232 Points Higher, Led by Gains in Banking, Finance and Auto Stocks

After swinging over 800 points during the day, the 30-share index closed 232.24 points or 0.74 per cent higher at 31,685.75.

Hopes of Gradual Economic Recovery Weigh on Gold

Gold prices ended higher in the previous three sessions, and have risen about 17% since mid-March, as uncertainty remained with the virus spreading and as U.S.-China trade tensions re-emerged.

Asia Gasoil Margins Drop to Record Low Amid Signs of Indian Export Surge

India's April gasoil exports closed at a four-month high of 2.73 million tonnes, compared with 2.53 million tonnes in March, according to Refinitiv oil research assessments.

Rupee Slips 18 Paise to 75.81 Against US Dollar in Early Trade

Forex traders said the weakness in the rupee was largely due to the strengthening US dollar. Besides, rising coronavirus cases in the country also weighed on the local unit.

Sensex Drops Over 200 Points in Early Trade, Nifty Below 9,200 Amid Covid-19 Concerns

ITC was the top loser in the Sensex pack, tanking nearly 6 per cent, followed by Axis Bank, Titan, Bajaj Auto, Maruti, M&M, L&T and IndusInd Bank.

India's Services Activity Collapses as Coronavirus Paralyses Global Economy: PMI

The grim result for the industry, the engine of economic growth and jobs, underlined the pandemic's sweeping impact across India as authorities extended a nationwide lockdown.

Govt to Gain Over Rs 1.5 Lakh Cr this Fiscal From Record Excise Duty Hike on Petrol & Diesel

The government hiked excise duty on petrol by Rs 10 per litre and that on diesel by Rs 13 a litre to mop up gains arising from international oil prices falling to a two-decade low.

Home Rental Company Airbnb Lays off 1,900 People as Coronavirus Slumps Business

With millions of tourists canceling plans for vacations, work trips and family visits, Airbnb earlier this year said it was allocating $250 million to help offset losses incurred by hosts.

Oil Prices Fall as Rising US Inventories Reassert Supply Concerns

US West Texas Intermediate (WTI) crude futures fell as much as 2.1 per cent to $24.05 a barrel and were down 14 cents at $24.41 a barrel at 0201 GMT. WTI has snapped a five-day winning streak.

Govt Hikes Excise Duty on Petrol by Rs 10 a Litre, Diesel by Rs 13 a Litre; No Change in Retail Rates

These duty rate changes will come into effect from May 6.